PJSC “LUKOIL” is one of the largest vertically integrated oil and gas companies in the world. The share of the company for more than 2% of global oil production and about 1% of proven reserves of hydrocarbons. With a full production cycle, PJSC “LUKOIL” has full control over the entire production chain – from oil and gas to oil products.

FMD assess the capital structure of PJSC “LUKOIL” for the period 2012 – 2014 gg.

Materials and methods

In the first stage of capital evaluation of PJSC “LUKOIL” will consider the comparative analytical balance in society gap osnonvyh its sections [1, c.8].

In the first stage we carry out a comparative analysis of the dynamics of change in the immobilized assets of PJSC “LUKOIL”. The dynamics of their changes is shown in Table 1.

Table 1 – Changes in the immobilized assets of PJSC “LUKOIL”

|

Index’s |

2012 |

2013 |

2014 |

Derivation 2014/2013 |

| 1.1. Intangible assets and results of research and development |

397361 |

383089 |

393925 |

10836 |

| 1.2. Fixed assets |

7532039 |

13138136 |

13350116 |

211980 |

| 1.3. Long-term investments |

661015690 |

959049433 |

1148294380 |

189244947 |

| 1.4. Other |

5595982 |

738619 |

1120256 |

381637 |

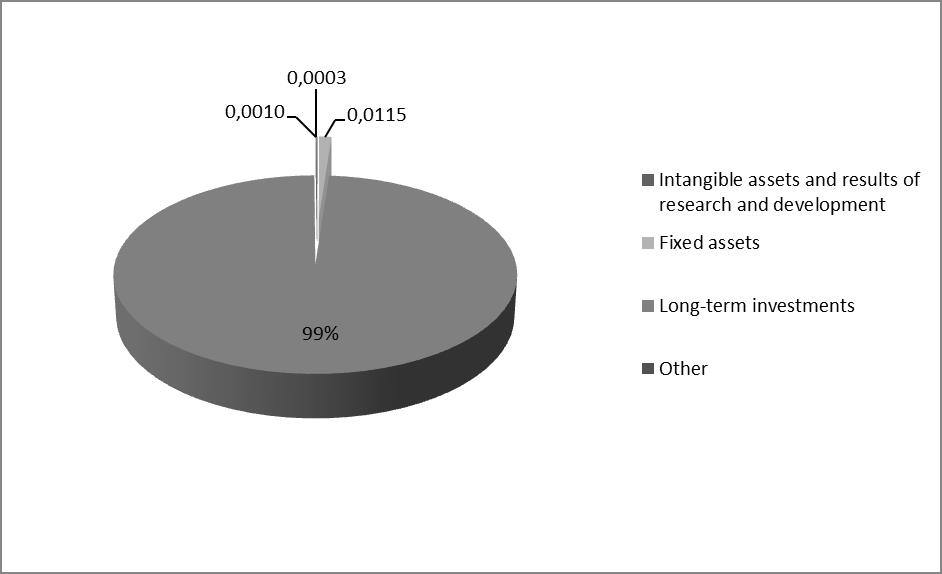

As shown in Table 1 and Figure 1, the largest share in the immobilized assets comprise long-term investments (99%). Other types of assets imobilizatsionnyh insignificant. This is due to significant investments PJSC “LUKOIL” in the subsidiaries and associates of the Group [2, c.85].

It should be noted that most sostavlyayayuschih immobilizoovannyh assets increased compared with the year 2012 in comparison with the year 2013 observed multidirectional diniamika.

So the dynamics of aggregate indicators reflect changes in the volume of amortization of intangible assets and research and development is positive. This indicator increased in comparison with the same period of 2013, but in comparison with 2012 there was a decrease of this index by 3 436 thousand. Rub. and amounted to 393 925 thousand. rub. [3, c.390]

Changes in compiling this index – the results of research and development is negative. Otkloenie on the results achieved in 2012 sostavlet (-50 141) thousand. Rub.

At the same time the negative dynamics of this index is associated with a reduction in the size of R & D results in otraennyh sostve immobilizoannyh assets of PJSC “LUKOIL”.

In this case the absolute value of intangible assets compared with the same period in 2012 increased and amounted at 31.12.2014 354 221 thous. Rubles. [4, c.240].

The highest growth is observed intangible assets for the period from 31.12.2012 on 31.12.2013. At the end of this period, the value of intangible assets increased and amounted to 5,705,072 thousand. Rubles (Table 1).

Fixed assets of PJSC “LUKOIL” for periodc 31.12.2013 31.12.2014 increased by 211 980 thousand. Rub. and amounted to 13,350,116 thousand. rub.

A significant increase in the cost of fixed assets occurred during the period from 31.12.2012 until 31.12.2013, when the value of the property increased by 5,606,097 thousand. Rub. and amounted to 13,138,136 thousand. rub. The greatest absolute value of 13,350,116 thousand. Rub. fixed assets value reached in 2014.

Over the entire period under review have been absent profitable enterprise investments in tangible assets, which indicates the absence of long-term investments in tangible assets in the enterprise.

Long-term investments in the period from 31.12.2012 on 31.12.2014 increased in absolute terms by 48 727 8690 thousand. Rub., In relative to 42.43% [5, c.34].

The absolute value of other non-current assets for the period from 31.12.2012 till 31.12.2014 has decreased by 4,618,898 thousand. Rub. and amounted to 580 347 thousand. rub.

Table 2 – Changes in current assets of PJSC “LUKOIL”

|

Index’s |

2012 |

2013 |

2014 |

Derivation 2014/2013 |

| 1. Current assets | ||||

| 1.1. Stock |

63748 |

128131 |

217765 |

89634 |

| 1.2. Receivables |

150555599 |

168113561 |

181891930 |

13778369 |

| 1.3. Short-term investments |

347274244 |

142331861 |

337746230 |

195414369 |

| 1.4. Cash |

15550233 |

12393373 |

72481947 |

60088574 |

| 1.5. Other |

0 |

0 |

0 |

0 |

| TOTAL FOR SECTION II |

513443824 |

322966926 |

592337872 |

269370946 |

The structure of the current assets of PJSC “LUKOIL”, is shown in Figure 2.

The significant weight in the overall balance sheet structure is subjected to be carried summma VAT which is recoverable from the Russian budget.

It should be noted that at the beginning and end of the study period, this figure has a large weight in the total balance sheet structure. Also, its absolute value increased by 157 072 thous. Rubles. [6, c.22].

Index of accounts receivable for the period from 31.12.2012 till 31.12.2014 has increased. The largest increase occurred in the period from 31.12.2012 on 31.12.2014. During this period, this figure has changed to (31,336,331 thousand. Rub.) [7, c.24].

The share of this indicator in the total amount of working capital sotstavilo 29.32% as at 31.12.2012 and 30.71% as at 31.12.2014 year.

It should be noted that for the period from 31.12.2012 till 31.12.2014, the share of receivables exceeds the standard value, which constitutes 25-27% of the total current assets [8, c.130].

The level of investments of PJSC “LUKOIL” has decreased by 9,528,014 thousand. Rub. This is explained by the reduction of investments in the company’s funds kratkorsrochnye securities of the corporate sector as well as in government securities [9, c.60].

Most likivdnaya component of the balance sheet asset of the enterprise – the funds for the period from 31.12.2012 till 31.12.2014 year increased by 56,931,714 thousand rubles.. and reached at 31.12.2014 72,481,947 thousand. rub.

Index stocks with a value of 31.12.2012 on 31.12.2014 decreased in absolute terms by 3055 thousand. Rub. and amounted to 31 076 thousand. rub.

The most significant fall took place on 31.12.2014 to 31.12.2013. During this period, the value of stocks decreased by 1583 thousand. Rub.

Dynamics of PJSC “LUKOIL” shareholders’ equity is shown in Table 3.

Table 3 – Changes in capital soobstvenno PJSC “LUKOIL”

|

Index’s |

2012 |

2013 |

2014 |

Derivation 2014/2013 |

| 1. Equity | ||||

| 2.1. Authorized capital |

21264 |

21264 |

21264 |

0 |

| 2.2. Extra capital |

12625114 |

12625113 |

12625113 |

0 |

| 2.3. Reserve capital |

3191 |

3191 |

3191 |

0 |

| 2.4. Profit (Loss) |

726645569 |

851528337 |

1121448545 |

269920208 |

| TOTAL FOR SECTION III |

739295138 |

864177905 |

1134098113 |

269920208 |

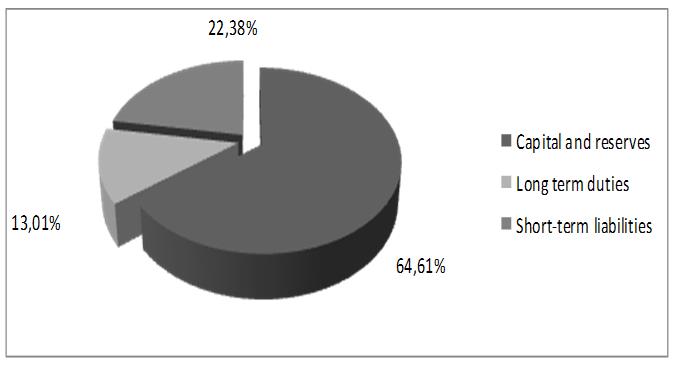

The structure of the liabilities of PJSC “LUKOIL”, is shown in Figure 3.

Figure 3 illustrates the main components of the balance sheet liability as of 31.12.2014. Own capital of PJSC “LUKOIL” is 64.6% of the total Company liabilities, non-current liabilities amount to 13.01% of the company’s liabilities, while the share of short-term liabilities is equal to 22.38%.

Carry out an assessment of its own capital of the enterprise. It is composed on 31.12.2014 is possible to allocate additional capital, capital reserve and retained earnings [10, c.95].

The absolute value of the additional capital decreased by 1 thousand. Rub. and amounted to 12,625,113 thousand. rub.

It should be noted that the balance of the reserve capital structure is present, the absolute value of which amounted to 3191 thousand. Rub.

According to the balance sheet can be seen that at the end of each period in the company’s balance sheet reflected retained earnings of the company. According to the balance of retained earnings of the absolute figure rose to 394 802 976 thous. Rubles. and amounted to 1,121,448,545 thousand. rub. [11, c.536].

Table 4 – Changes in long-term debt capital of PJSC “LUKOIL”

|

Index’s |

2012 |

2013 |

2014 |

Derivation 2014/2013 |

| 1. Long-term liabilities | ||||

| 1.1. Borrowed funds |

2383413 |

73145713 |

228021462 |

154875749 |

| 1.2. Other borrowed funds |

140208 |

1005199 |

426612 |

-578587 |

| TOTAL FOR SECTION IV |

2523621 |

74150912 |

228448074 |

154297162 |

The value of long-term debt peaked in the amount of 228 448 074 thous. Rubles. to 31.12.2014, value of this indicator increased in comparison with the value at 31.12.2012 on 22 592 4453 thousand. rub. In relative terms, the increase amounted to 1.1% of the original level [12, c.194].

The highest value in the structure of long-term liabilities at beginning of period are borrowed funds, which account at beginning of period 94.44% of the total long-term liabilities. At the end of the period the level of long-term liabilities amounts to 99.81% of the total long-term liabilities [13, c.150].

Table 5 – Changes in short-term debt capital of PJSC “LUKOIL” [14, c. 8]

|

Index’s |

2012 |

2013 |

2014 |

Derivation 2014/2013 |

| 1. Current liabilities | ||||

| 1.1. Loans |

311052465 |

213144333 |

193383794 |

-19760539 |

| 1.2. Accounts payable |

133341022 |

142898544 |

198408144 |

55509600 |

| 1.3. Revenue of the future periods |

0 |

0 |

0 |

0 |

| 1.4. Provisions for liabilities and contingent liabilities at |

0 |

0 |

0 |

0 |

| 1.5. Other |

1772650 |

1904509 |

1158424 |

-746085 |

| TOTAL FOR SECTION V |

446166137 |

357947386 |

392950362 |

35002976 |

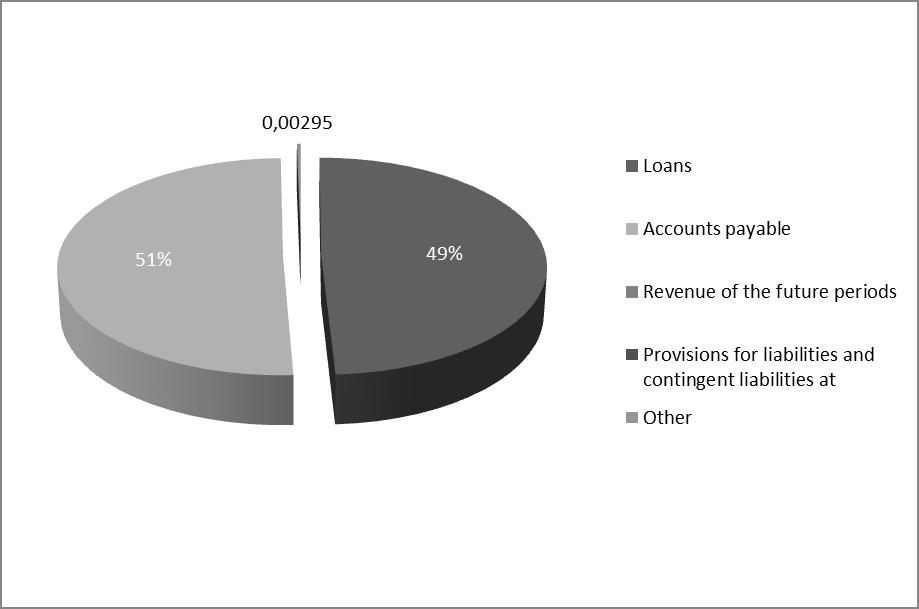

The absolute value of short-term borrowings on 31.12.2014 was reduced compared to 31.12.2012 to 117 668 671 thousand. Rub. and amounted to 193 383 794 thous. rubles. [16, c.480].

Indicator payable PJSC “LUKOIL” has increased in comparison with the similar indicator as of 31.12.2012 to 65,067,122 thousand. Rub. and amounted to 198 408 144 thous. rubles. The largest increase in this indicator was observed in the period from 31.12.2013 till 31.12.2014 years [17, c.5].

It should be noted that during the analyzed period there was a change in the ratio between accounts receivable and accounts payable [18, c.177].

At the beginning of the analyzed period 31.12.2012 receivables increased accounts by 12.9%, and as of 31.12.2014 the accounts payable were higher receivables by 9.1% [19, c.14].

The following conclusions can be drawn on the basis of the analysis.

the company’s balance sheet total increased in 2014 and amounted to 421 990 567 thous. rubles. This trend is characterized by positive economic activity of the enterprise [20, c.25].

conclusion

The situation with the ratio of accounts receivable and accounts payable of the enterprise, as well as the capital structure of the enterprise requires optimization.

According to the results of the analysis, the following conclusions – the whole structure of the balance of PJSC “LUKOIL” is positive, but in the dynamics of change in the structure of assets and liabilities of the company there are negative trends, which require measures to improve the balance sheet structure of PJSC “LUKOIL” [21, c.164 ].

References

- Артемьев А. В. Оценка динамики и структуры финансовых результатов ОАО «АВТОВАЗ»//Азимут научных исследований: экономика и управление. 2014. № 3. С. 7-10.

- Мальцев А. Г., Мальцева Т. А. Оценка ре-зультатов деятельности ОАО «АВТОВАЗ» в 2013 ГОДУ//Карельский научный журнал. 2014. № 3. С. 83-87.

- Ярыгин А. Н., Колачева Н. В., Палфёрова С. Ш. Методы нахождения оптимального решения экономических задач многокритериальной оптимизации//Вектор науки Тольяттинского государственного университета. 2013. № 1 (23). С. 388-393.

- Колачева Н. В., Палферова С. Ш. Относи-тельные статистические показатели стохастических моделей//Известия Самарского научного центра Российской академии наук. 2006. № S2-2. С. 234-237.

- Иванов Д. Ю. Прикладная модель системы материального стимулирования (на примере предприятия специального машиностроения)//Проблемы управления. 2010. № 6. С. 33-37.

- Курилова А. А. Методические положения оценки рисков на предприятиях автомобильной промышленности//Карельский научный журнал. 2013. № 2. С. 21-23.

- Курилова А. А., Курилов К. Ю. Внутренний контроль и аудит на предприятиях автомо-бильной промышленности//Азимут научных исследований: экономика и управление. 2013. № 4. С. 22-26.

- Булов В. Г. Методы информационного обеспечения управления на предприятиях автомобильной промышленности//Вестник Поволжского государственного университета сервиса. Серия: Экономика. 2013. № 1 (27). С. 127-136.

- Иванов Д. Ю. Экономико-математическая модель системы материального стимулирования работников предприятия специального машино-строения//Вестник Самарского государственного аэрокосмического университета им. академика С. П. Королёва (национального исследовательского университета). 2010. № 3. С. 54-62.

- Иванов Д.Ю. Модель анализа и прогнозирования динамики промышленного производства и ракетно-космической отрасли российской федерации // Актуальные проблемы экономики и права. 2016. Т. 10. № 2 (38). С. 93-101.

- Засканов В.Г., Иванов Д.Ю. Методологические аспекты повышения эффективности организации процессов проектирования, производства и эксплуатации авиационных изделий // Известия Самарского научного центра Российской академии наук. 2015. Т. 17. № 6-2. С. 535-539.

- Курилов К.Ю. Анализ деятельности предприятия с учетом влияния цикличности // Инновационное развитие экономики. 2013. № 6 (17). c. 193.

- Ajupov A.A., Artamonov A.B., Kurilov K.U., Kurilova A.A. Reconomic bases of formation and development of financial engineering in financial innovation // Mediterranean Journal of Social Sciences. 2014. Т. 5. № 24. c. 149.

- Курилов К.Ю. Прогнозы развития мировой автопромышленности // Международный научный журнал. 2011. № 5. c. 7.

- Курилова А.А. Формирование эффективной структуры организации // Карельский научный журнал. 2014. № 3. c. 72.

- Kurilov K.Y. World and russian automotive industry development perspectives // Studies on Russian Economic Development. 2012. Т. 23. № 5. С. 478-487.

- Ajupov A.A., Kurilova A.A., Ivanov D.U. Optimization of interaction of industrial enterprises and marketing network // Asian Social Science. 2015. Т. 11. № 11. С. 1-6.

- Ajupov A.A., Kurilova A.A., Sherstobitova A.A. The development of housing-and-communal services power supply system in samara region // Asian Social Science. 2015. Т. 11. № 11. С. 176-182.

- Ajupov A.A., Kurilova A.A., Ivanov D.U.Criterion for the cost-effectiveness of aircraft engines conversion // Asian Social Science. 2015. Т. 11. № 11. С. 12-15.

- Ajupov A.A., Kurilova A.A., Ozernov R.S. Issues of coordinated cooperation for forming leasing payments schedules // Asian Social Science. 2015. Т. 11. № 11. С. 23-29.

- Ajupov A.A., Kurilova A.A., Ivanov D.U. Application of financial engineering instruments in the russian automotive industry // Asian Social Science. 2015. Т. 11. № 11. С. 162-167.

View this article in Russian

View this article in Russian