PJSC “LUKOIL” is one of the largest vertically integrated oil and gas companies in the world. The share of the company for more than 2% of global oil production and about 1% of proven reserves of hydrocarbons. With a full production cycle, PJSC “LUKOIL” has full control over the entire production chain – from oil and gas to oil products [1, p.8].

Before assessing the efficiency of capital use PJSC “LUKOIL” will analyze the dynamics of the main components of the profit of PJSC “LUKOIL”.

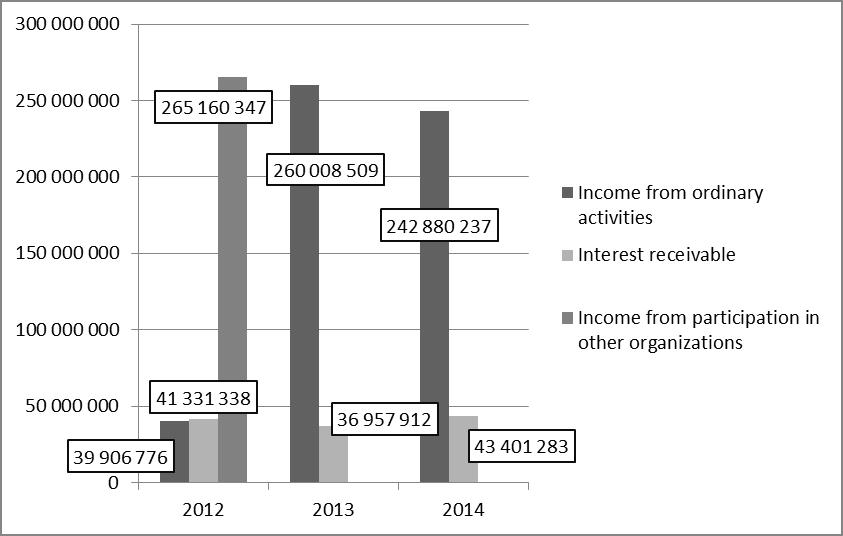

Changes in the company’s income is shown in Figure 1.

As seen in Figure 1, the dynamics of changes in income of PJSC “LUKOIL” is positive for 2014 revenues surpass its absolute value of the same period of 2013 and 2012.

In 2014, the company PJSC “LUKOIL” revenues increased by 108,165 592tys. rub. and amounted to 460 730 789 thousand. rubles [2, c.85].

Changes in income from ordinary activities is shown in Figure 2.

Figure 2 shows that the income from ordinary rose by 202 973 461 thous. Rubles. In relative terms, revenues from ordinary activities increased by 508.62% [3, c.390].

Expected interest income increased by 2,069,945 thousand. Rub. or 5.01%

Revenues PJSC “LUKOIL” of participation in other companies decreased by 265 160 347 thous. Rubles. In relative terms, revenues from participation decreased by 100% in other organizations [4, c.3].

Other income of PJSC “LUKOIL” grew in absolute terms by 168 282 533 thous. Rubles. or 2728.88%.

The largest share in the composition of the organization income is income from ordinary activities. The share of these revenues is 52.72% [4, c.240].

Estimating income of PJSC “LUKOIL” will assess the costs that arise during the preparation of the company’s revenue.

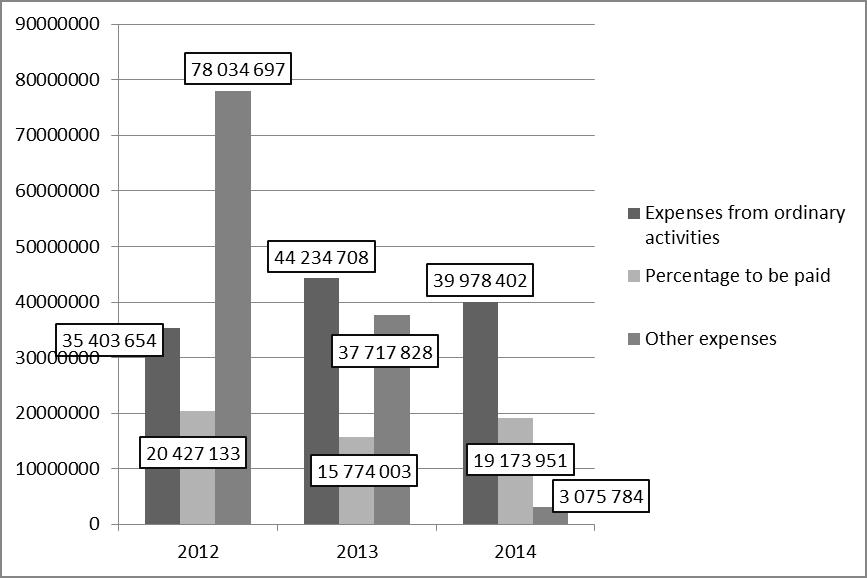

Dynamics of PJSC “LUKOIL” expenditures is shown in Figure 3.

Expenses PJSC “LUKOIL” decreased by 71,637,347 thousand. Rub. and amounted to 62,228,137 thousand. rub.

Let us consider the main components of the company’s expenses [5, c.6].

In absolute terms, expenditure on ordinary activities increased by 4,574,748 thousand. Rub. or 12.92% in relative terms.

Based on the assessment of the financial statements it can be concluded that the interest expense decreased by 1,253,182 thousand. Rub. in relative terms, the increase in interest payable amounted to 6.31% [7, c.25].

The increase in other expenses in absolute terms amounted to 74,958,913 thousand. Rub., And in relative terms by 96.06%.

The total volume of PJSC “LUKOIL”, is dominated by the cost of expenses from ordinary activities 64.24%.

In general, the analysis of the main components of the profit of PJSC “LUKOIL” has shown that the dynamics of the company’s financial performance is positive, although some indicators, such as income from participation in other organizations tend to decrease [8, c.129].

Let’s consider the relative indicators characterizing the profitability of PJSC “LUKOIL”.

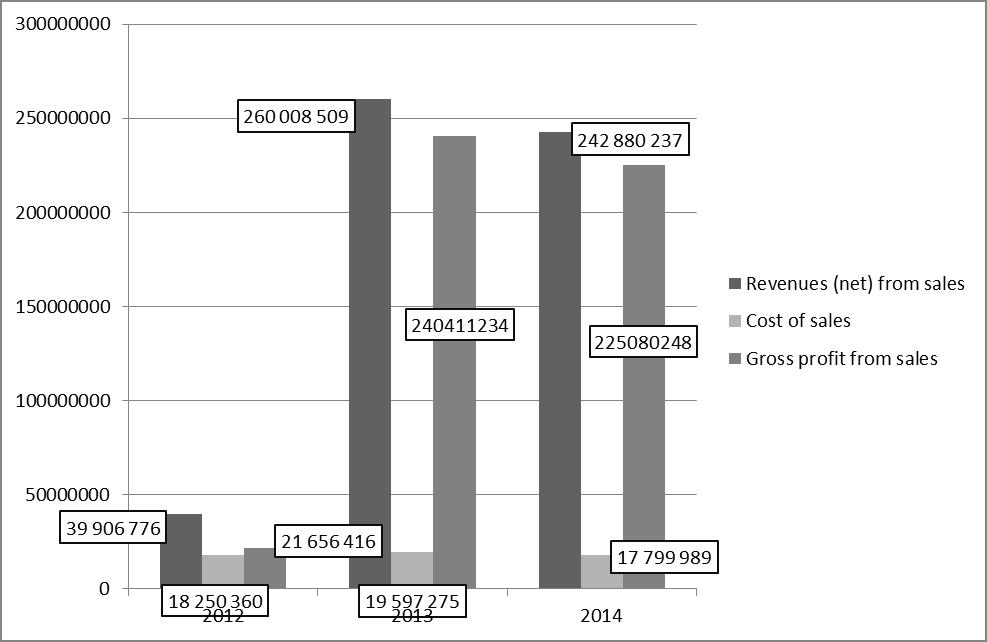

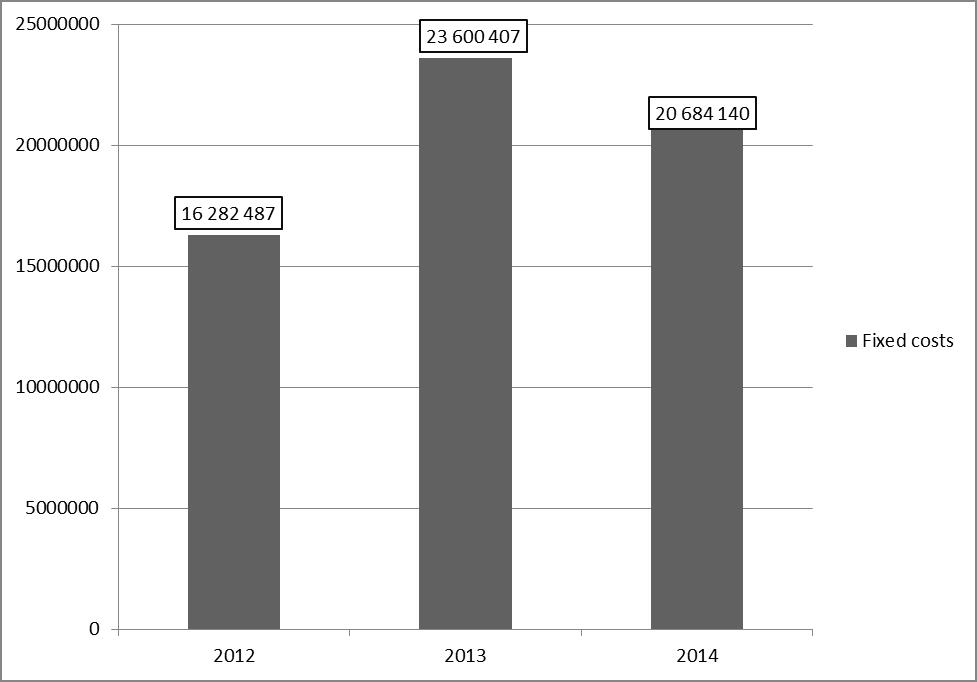

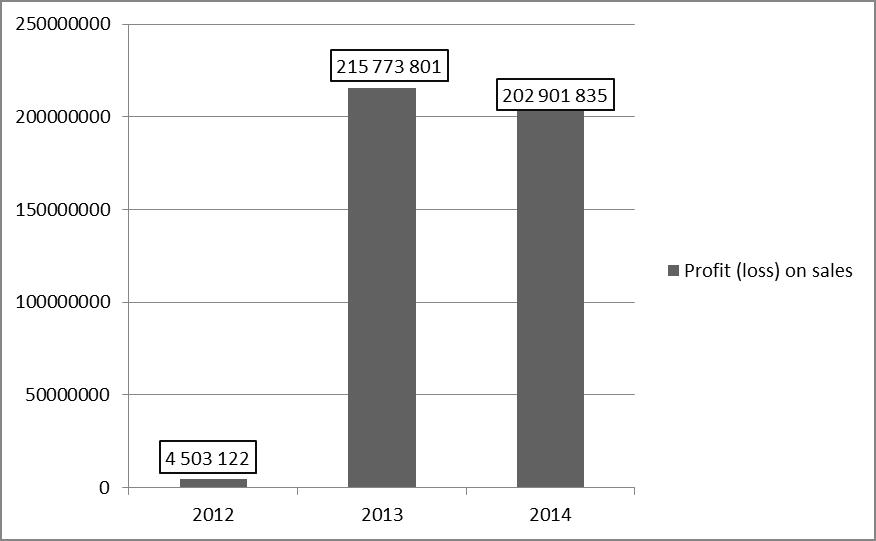

Dynamics of the major factors influencing the formation of the financial results of PJSC”LUKOIL”, is shown in Figure 5 and Figure 6.

As shown in Figure 6 for the period from 31.12.2012 till 31.12.2014, the company PJSC “LUKOIL” has increased the size of the resulting gross profit. The main factors that contributed to the profit growth

of steel – 99.8% change in revenue by (-0.22%) change in cost [10, c.95].

Changes in administrative expenses is positive, compared with 2013 a year, a decrease in administrative expenses, which positively characterizes the economic activity of the enterprise,

but as a whole the rise of administrative expenses compared with 2012, indicating that the negative trend in the economic activity of the enterprise [11, c .540].

The growth of profit on sales on 198 398 713 thous. Rubles. due to the growth in gross profit.

The increase in the accounting profits of PJSC “LUKOIL” on 179 802 939 thous. Rubles. It was due to the growth in profits from sales to 66.91% and an

increase in the balance of other income and expenses to 110.34%.

On the formation of the net profit (loss) for the reporting period provided by: an increase in profit before tax – 12.07%, and an increase in the amount

of taxes paid from profits to 16.7% [12, c. 194].

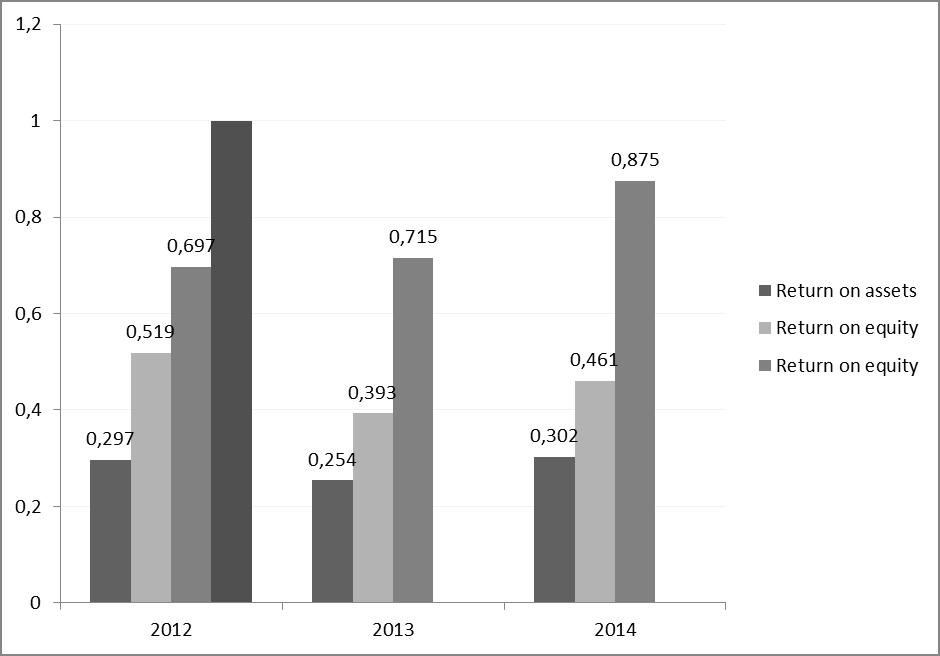

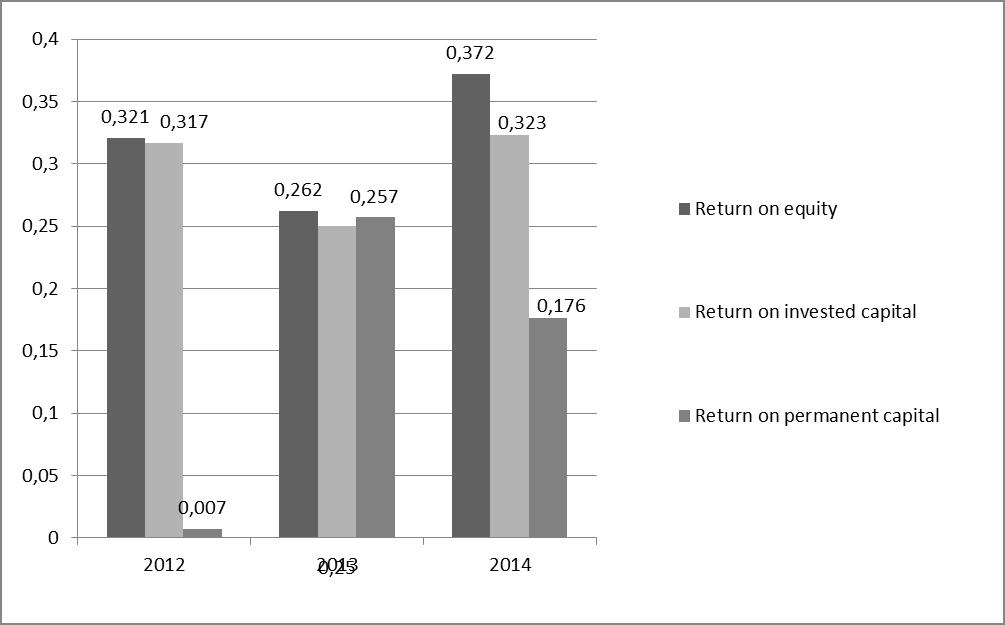

Carry out an assessment of return on capital of PJSC “LUKOIL” on the basis of available data, the financial statements of the company [13, c.150].

return on capital evaluation results are shown in Figure 9.

As can be seen from Table 9 “LUKOIL” return on capital performance PAO have mixed trends. For example, the rate of return on equity decreased compared to the year 2012,

but has grown in comparison with 2013 year. of return on assets, on the contrary it increased compared with 2012 [14, c.8].

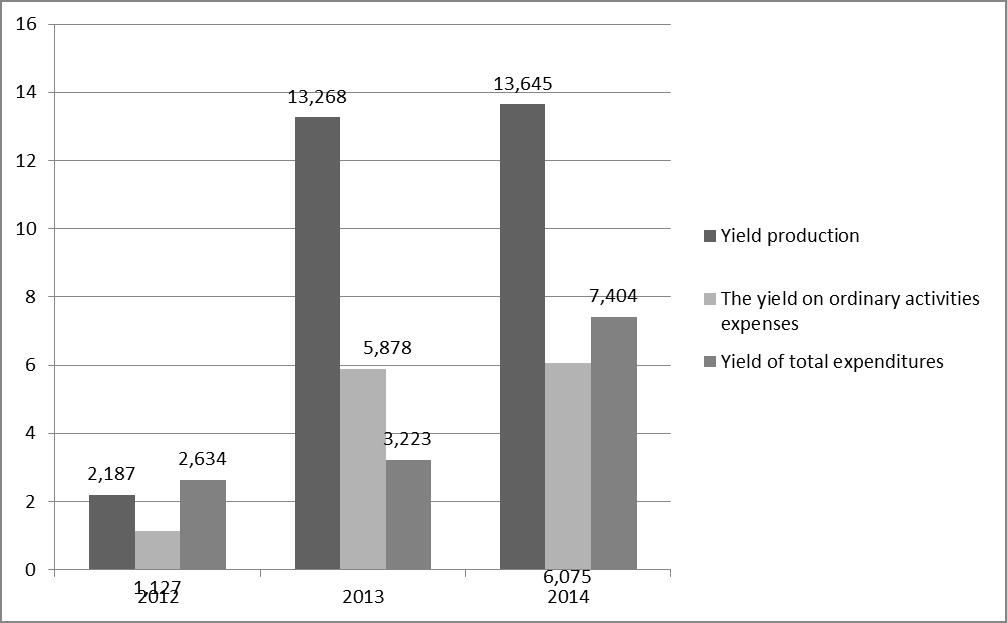

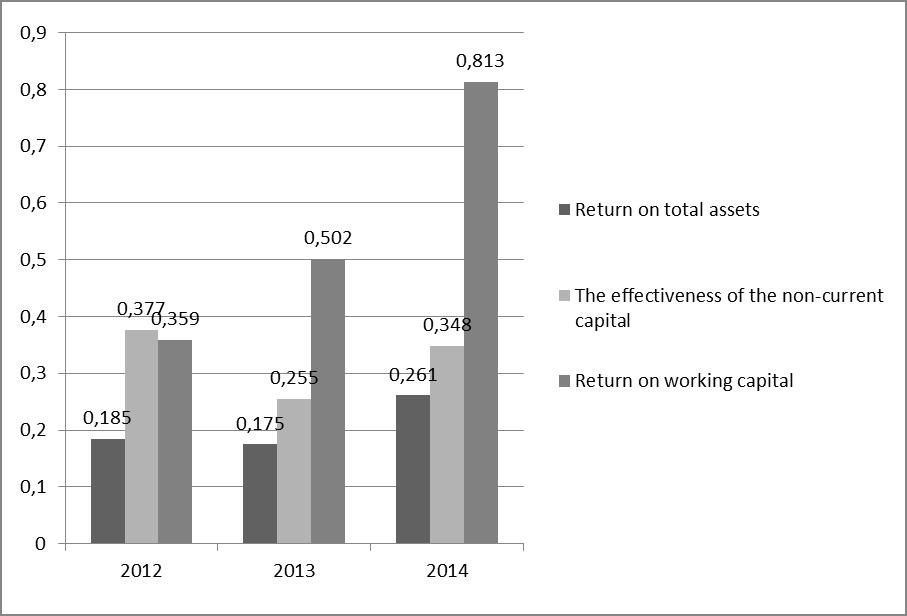

Other relative profitability of PJSC “LUKOIL”, figures are shown in Figure 10.

As seen in Figure 10 Dynamics of changes in relative profitability indicators of PJSC “LUKOIL” positive.

Next, analyze the rate of financial profitability of the company, ie return on borrowed capital, the ratio of profit to loan capital, sources of venture funds and their components [16, c.480].

Changes in these parameters is shown in Figure 11 and Figure 12.

The figures 11 and 12 shows that the dynamics of change in profitability is a positive trend. Compared with 2012, in 2014 there was growth in all profitability indicators [17, c. 5].

On specific issues in the enterprise can say that there is a decrease in profitability in 2013, which may indicate recurrent problems associated with the activities of the enterprise [18, c.180].

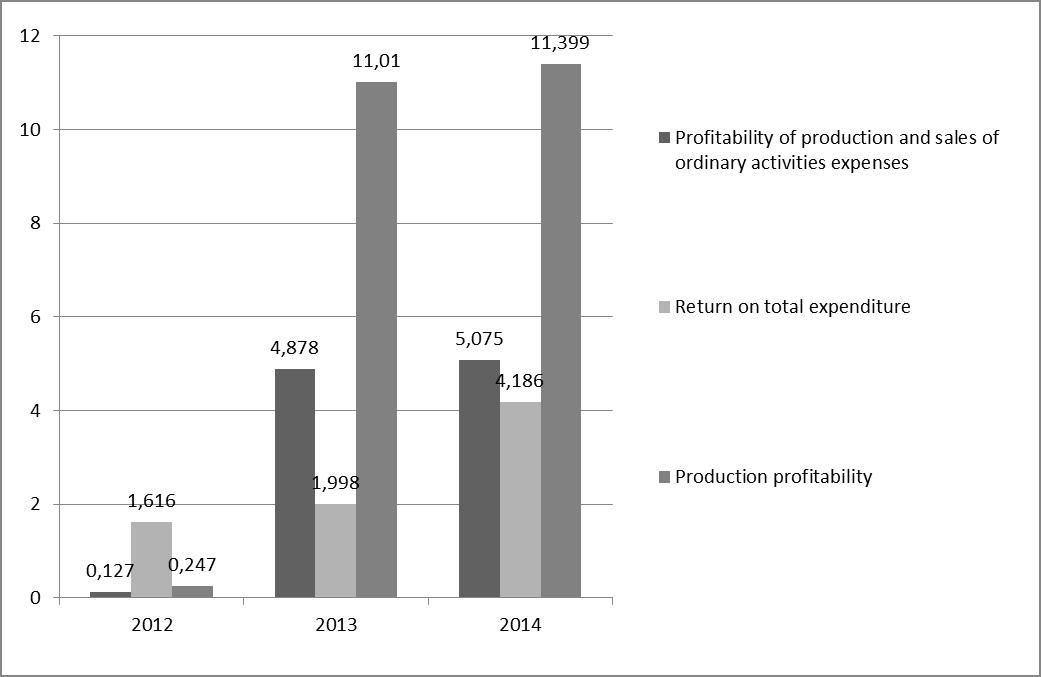

Economic profitability of PJSC “LUKOIL”, is shown in Figure 13 shows a similar trend.

Changes in profitability of production and sales (see Figure 14 and Figure 15) as a whole is positive, it may be noted positive dynamics of changes in the profitability of production in comparison with 2012, 2013 year [19, c. 143].

In conclusion we will assess the relation of own and borrowed funds of the company, as well as the conduct of liquidity coefficient values covering ratio of equity and debt, profitability and production activity of the enterprise on the basis of the available accounting data [20, c.25].

Dynamics of changes in these indicators over the period from 2012 to 2014 is shown in Table 2.

Table 2 – Dynamics of indicators of creditworthiness harrakterizuyuschih PJSC “LUKOIL”

|

Index’s |

Value |

|||

|

2012 |

2013 |

2014 |

Derivation 2014/2012 |

|

|

1 |

2 |

3 |

4 |

5 |

| 1. Absolute liquidity ratio |

0.813 |

0.432 |

1.044 |

0.612 |

| 2. Interim coverage ratio |

1.151 |

0.902 |

1.507 |

0.605 |

| 3. The current liquidity ratio (total coverage ratio) |

1.151 |

0.902 |

1.507 |

0.605 |

| 4. The ratio of debt to equity |

0.622 |

0.667 |

0.646 |

-0.021 |

| 5. Profitability of products (or return on sales) |

0.113 |

0.83 |

0.835 |

0.005 |

| 6. The profitability of the company |

5.458 |

0.807 |

1.531 |

0.724 |

The assessment of capital structure of PJSC “LUKOIL”, as well as the assessment of the return on capital allowed to reveal that the whole society is functioning stably, but in his work observed a number of negative trends [21, c.160].

This negative trend is related to the economic instability in Russia, the depreciation of the ruble and oil prices, and the introduction of sanctions against Russia the European Union and the United States.

References

- Артемьев А. В. Оценка динамики и структуры финансовых результатов ОАО «АВТОВАЗ»//Азимут научных исследований: экономика и управление. 2014. № 3. С. 7-10.

- Мальцев А. Г., Мальцева Т. А. Оценка ре-зультатов деятельности ОАО «АВТОВАЗ» В 2013 ГОДУ//Карельский научный журнал. 2014. № 3. С. 83-87.

- Ярыгин А. Н., Колачева Н. В., Палфёрова С. Ш. Методы нахождения оптимального решения экономических задач многокритериальной оптимизации//Вектор науки Тольяттинского государственного университета. 2013. № 1 (23). С. 388-393.

- Колачева Н. В., Палферова С. Ш. Относи-тельные статистические показатели стохастических моделей//Известия Самарского научного центра Российской академии наук. 2006. № S2-2. С. 234-237.

- Иванов Д. Ю. Прикладная модель системы материального стимулирования (на примере предприятия специального машиностроения)//Проблемы управления. 2010. № 6. С. 33-37.

- Курилова А. А. Методические положения оценки рисков на предприятиях автомобильной промышленности//Карельский научный журнал. 2013. № 2. С. 21-23.

- Курилова А. А., Курилов К. Ю. Внутренний контроль и аудит на предприятиях автомо-бильной промышленности//Азимут научных исследований: экономика и управление. 2013. № 4. С. 22-26.

- Булов В. Г. Методы информационного обеспечения управления на предприятиях автомобильной промышленности//Вестник Поволжского государственного университета сервиса. Серия: Экономика. 2013. № 1 (27). С. 127-136.

- Иванов Д. Ю. Экономико-математическая модель системы материального стимулирования работников предприятия специального машино-строения//Вестник Самарского государственного аэрокосмического университета им. академика С. П. Королёва (национального исследовательского университета). 2010. № 3. С. 54-62.

- Иванов Д.Ю. Модель анализа и прогнозирования динамики промышленного производства и ракетно-космической отрасли российской федерации // Актуальные проблемы экономики и права. 2016. Т. 10. № 2 (38). С. 93-101.

- Засканов В.Г., Иванов Д.Ю. Методологические аспекты повышения эффективности организации процессов проектирования, производства и эксплуатации авиационных изделий // Известия Самарского научного центра Российской академии наук. 2015. Т. 17. № 6-2. С. 535-539.

- Курилов К.Ю. Анализ деятельности предприятия с учетом влияния цикличности // Инновационное развитие экономики. 2013. № 6 (17). c. 193.

- Ajupov A.A., Artamonov A.B., Kurilov K.U., Kurilova A.A. Reconomic bases of formation and development of financial engineering in financial innovation // Mediterranean Journal of Social Sciences. 2014. Т. 5. № 24. c. 149.

- Курилов К.Ю. Прогнозы развития мировой автопромышленности // Международный научный журнал. 2011. № 5. c. 7.

- Курилова А.А. Формирование эффективной структуры организации // Карельский научный журнал. 2014. № 3. c. 72.

- Kurilov K.Y. World and russian automotive industry development perspectives // Studies on Russian Economic Development. 2012. Т. 23. № 5. С. 478-487.

- Ajupov A.A., Kurilova A.A., Ivanov D.U. Optimization of interaction of industrial enterprises and marketing network // Asian Social Science. 2015. Т. 11. № 11. С. 1-6.

- Ajupov A.A., Kurilova A.A., Sherstobitova A.A. The development of housing-and-communal services power supply system in samara region // Asian Social Science. 2015. Т. 11. № 11. С. 176-182.

- Ajupov A.A., Kurilova A.A., Ivanov D.U.Criterion for the cost-effectiveness of aircraft engines conversion // Asian Social Science. 2015. Т. 11. № 11. С. 12-15.

- Ajupov A.A., Kurilova A.A., Ozernov R.S. Issues of coordinated cooperation for forming leasing payments schedules // Asian Social Science. 2015. Т. 11. № 11. С. 23-29.

- Ajupov A.A., Kurilova A.A., Ivanov D.U. Application of financial engineering instruments in the russian automotive industry // Asian Social Science. 2015. Т. 11. № 11. С. 162-167.