The idea of a portfolio analysis model to minimize investment risks was first formalized by Nobel laureate, Markowitz [1]. The classical investment portfolio theory is presented in the works by Markowitz [1], Sharpe[2], Tobin[3], Blanc, Lintner, Gitman, Fabozzi [4] and the others.

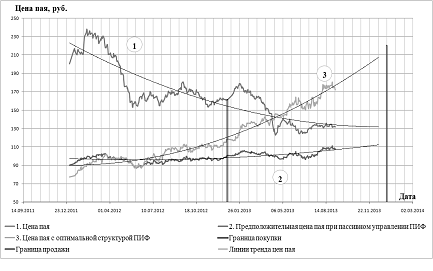

The unit investment trust share prices decrease, presented on picture 1, makes the portfolio structure optimization actual.

Figure 1 – “Finam First” share prices dynamics

The management system of the fund “Finam First” analysis revealed the use of active asset management strategy, which implies changing the investment portfolio according to market trends [5, с. 260].

The mutual fund share prices forecast on the assumption of passive strategy use (the mutual fund structure was fixed in the period from 9.01.2012 to 6.09.2013) dynamics is increasing (figure 1). Aimed at portfolio structure optimization, the assets portfolio composition task was formalized. The aim implies the vector of shares of portfolio project ɣj choice in order to provide the profitability of portfolio financial investments maximization and the risk of loss minimization.

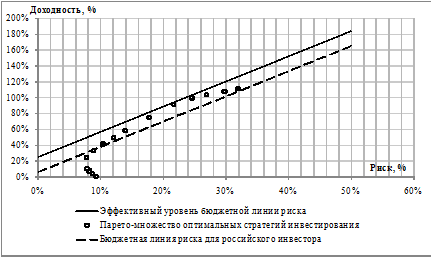

The optimization of portfolio structure, carried out by minimization of the risk level for a fixed level of the portfolio profitability, resulted at a variety of optimal portfolio strategies γ, united in the Pareto-ensemble, presented in figure 2. The budget line of risk is also presented in figure 2, the budget line of risk means the variety of the criteria values for equal “risk price” [6, с. 142-155]. The “risk premium” for Russian investor is defined during an additional statistical research, where the average rate of risk and the risk projects profitability are estimated using the data about dynamics of MICEX index in 2013. Analysis of the statistical information has shown that for Russian investor in 2014 the portfolio, providing the investment yield equal to 92% at risk of 22%, will be preferable.

Figure 2 – The multicriteria task solution

An additional decision of the multicriteria task using the method of approximating the Pareto-ensemble during vector optimization [7, с. 115] indicates that the most optimal, according to the principle of equal effectiveness, is a portfolio, providing the investment yield equal to 75% at risk of 17%, and characterizes the strategy of the Russian investor as aggressive. Figure 1 presents the dynamics of the unit investment trust «Finam First» share prices after implementation of the portfolio optimization. In regard to the original structure the profitability of financial investments portfolio with an optimal structure increased more than 7 times, with increasing of a risk in half.

Results and conclusions

The dynamics and structure of a unit investment trust «Finam First» [8] analysis and the following portfolio structure optimization, resulted into financial investments portfolio with an optimal structure. According to results of the research, passive management strategy is less risky and more profitable than active asset management, because of the regression more precise definition and the long-term strategy determination. However, it is effective only on the assumption of long-term investments and the trends of the projects monotony.

References

- Markowitz H. M. The optimization of a quadratic function subject to linear constraints. NJ: Naval Research Logistics Quarterly, 1956

- Sharpe W. F. A simplified model for portfolio analysis. NJ: Management Science, 1963.

- Tobin J. Liquidity Preference as Behavior Towards Risk// Review of Economic Studies, 1958.

- Fabozzi Frank J., Harry M. Markowitz. The Theory and Practice of Investment Management. Hoboken, 2002.

- Tsarihin K. S. Stock market and the world. М., 2008.

- Geraskin M.I. Innovation management in the modern economy. Samara: SSAU, 2005.

- Mashunin Yu.K. Engineering System Modeling on the Base of Vector Problem of Nonlinear Optimization //Control Applications of Optimization. Preprints of the Eleventh IFAC International Workshop. CAO 2000. Saint Petersburg, 2000.

- «Finam Ltd» official website: http://http://www.finam.ru.