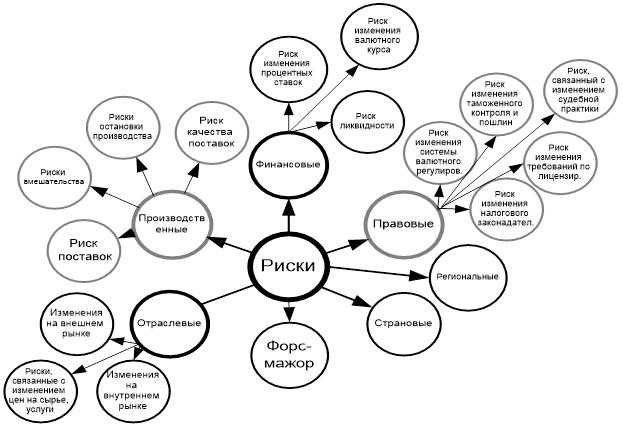

Companies in the automotive industry of its business there with a lot of risk – the risk of compliance with contractual relationships in the supply of components and raw materials to the risks associated with changes in the legal system and force majeure (see Figure 1). [1. c.132].

The set of risks faced by the automotive industry, leads to the necessity of hedging using a variety of methods, including using financial instruments. Phase minimize the consequences of the risk exposure to economic activity in the automotive industry must be preceded by a risk assessment in the automotive industry in terms of their probability of occurrence and the potential consequences of the volume, which will be called in the event of adverse circumstances [2, p.86].

In the process of risk assessment is carried out of Motor Vehicle Manufacturers:

- Description of the internal control processes in the automotive industry;

- Identification of potential risk events, risk identification sources – external and internal factors affecting the achievement of the objectives process;

- Quality (rating) assessment of the risks identified according to the criteria of the likelihood and consequences of the materiality of risk events;

- Preparation Process of Motor Vehicle Manufacturers risk map for risk significance of illustrations that are relevant to management.

Risk assessment usually produces typically services of the internal control and audit companies every year in the development of audit plans and selection processes for self-evaluation of risk enterprises for the next year.

Risk assessment is carried out structural units of the automotive industry companies are continuously in the normal course of business, to ensure the achievement of the goals automotive industry companies, as well as during the annual self-assessment of risks. In the event of a significant change in the risk assessment, the identified structural units in the normal course of business, the structural units are obliged to inform the service for internal control and audit of the enterprise, regardless of the timing of the self-assessment.

Service of internal control and audit of the enterprise – is coordinating the risk assessment in the structural divisions, develops methodologies and provides training, is heat map risks in the automotive industry on the basis of information from departments, uses its own risk assessment and the results of the risk assessment of structural units for audit planning and for preparation of external reporting in the automotive industry in terms of risk.

The structural division of the enterprise – carry out a risk assessment of its operations to make timely and informed decisions, develop measures (action plans) to respond to the risks and improving internal control, and monitor their implementation.

The following steps of risk assessment in the automotive industry.

The first step is to conduct a preliminary assessment of the inherent risks.

The participants of the risk assessment process for risk assessment must first examine the regulatory, organizational and administrative documents evidencing such important factors as the list of processes and sub-processes of the studied type of activity, the list of structural unit objectives, strengthening responsibility for risk management, policy documents on the management of risk.

At the initial stage of development risks in the automotive industry management systems, as well as the appearance of new activities in the automotive industry, assesses the inherent risks, which could take place in the absence of the individual process descriptions [3, p.8]. In this case, the risk assessment carried out by the internal control and audit, and the structural units of enterprises by experts on the basis of counting the number of risks inherent in the processes included in the system of internal control (see. Table 1).

Table 1 – Questions to assess the risks inherent in

| n/n | Questions for the risk assessment | Answer |

| 1. | Risks associated with suppliers | (1 have, 0 – no) |

| 2. | Risks associated with the promotion of products (such as loss of competitiveness, price dictates wholesale buyer) | (1 have, 0 – no) |

| 3. | Financial and economic risks (credit, liquidity, currency, unnecessary costs, buh.ucheta errors, etc.) | (1 have, 0 – no) |

| 4. | Legal and regulatory risks (loss of assets, falsification, fraud, sanctions, state agencies, courts) | (1 have, 0 – no) |

| 5. | Man-made risks (risks associated with production and environmental safety) | (1 have, 0 – no) |

| 6. | The risks of information systems | (1 have, 0 – no) |

| 7. | The risks of social problems and unrest in the workforce | (1 have, 0 – no) |

| 8 | Production risks (stop production / assembly line, faulty management solution) | (1 have, 0 – no) |

| 9 | Risks associated with quality | (1 have, 0 – no) |

On the sum of the responses refer to Table 1 given rating of process risk level (1 to 2 lower risk, from 3 to 4 average risk of 5 or higher – high risk)..

The second stage – conducting risk self-assessment and refinement of the preliminary risk assessment.

In order to identify and analyze the risks, heads of departments are obliged to carry out continuous monitoring. In order to ensure a systematic approach to the monitoring, risk self-assessment procedure is carried out on the automotive industry structural units, through surveys of structural units of personnel.

Assessing the current level of operational risk is carried out by filling the table with the assessment of the individual risk for each subprocess. Grade level of risk for each sub-process is calculated as the average for all the selected operational risks [4, c.148].

On the sum of the responses in the form of the process of risk self-assessment process is given a rating of risk levels (from 1 to 10, low risk, 11 medium risk and 20, from 21 to 40 high risk).

Based on the results of risk self-assessment to be confirmed preliminary assessment of inherent risks. The resulting risk assessment is used to build and update the thermal map of risks in the automotive industry – the list of internal control processes with color highlighting the level of risk.

The third stage involves an assessment of risk processes in the automotive industry.

Risk assessment in the automotive industry is based on a description of the risks inherent to each of the processes. For a deeper understanding of the risks in the existing processes and internal controls is recommended that the description of the processes. If the activity in question is included in the process model automobile industry enterprises control system, can be used a description of the process (subprocess) control system.

The criterion for the adequacy of the process model of the structural unit for the purposes of the internal control system is a reflection of all the functions, aimed at fulfilling the objectives units in the following areas:

- The effectiveness and efficiency of operations;

- Safekeeping of assets;

- The accuracy of all types of reporting;

- Compliance with contractual obligations, legal requirements and internal regulations of the automotive industry.

Simultaneously with the preparation of the graphical process model scheme is recommended that its text description. Text description of the process model is carried out in the form of comments on the implementation of certain functions of the process. Complete descriptions attached to the flowchart. In the course of this description it is worth noting the presence of sources of risks that can lead to risk events.

In the analysis of the processes by experts identified potential sources of risks – both external and internal factors that can cause risk events affecting the achievement of the objectives [5, c.25].

To assess the level of probability of risk events and the significance of their consequences, using a rating (one to five) assessment of risk events (see. Table 2 and Table 3).

Table 2 – The rating of the probability

| Probability | Description | Description |

| 5 | High probability | The event is almost certain to happen |

| 4 | Probably | The probability that an event will occur, large |

| 3 | Possible | It is possible that an event will occur |

| 2 | Low probability | Low probability that an event will occur |

| 1 | Minimum probability | The event will take place only in exceptional circumstances |

The rating of the likelihood and consequences of materiality is set separately for the inherent risk and residual risk. In reporting on the risk assessment includes information on residual risk, that is, taking into account the evaluation of the effectiveness of the control procedures provided for controlling this type of risk. To go from the risk assessment on the likelihood and consequences of significance to the simple (single) rating from one to five, using the mean value between the likely and significant consequences, rounded to the nearest whole number. Distribution Risk of Motor Vehicle Manufacturers by levels 1 to 5 is reflected in the risk assessment matrix.

Table 3 – The rating of significant effects

| Major consequence | Description | Description |

| 5 | Katastrocally | The monetary impact assessment of more than 500 mln. Rub., or the consequences of risk occurrence can not afford to fulfill the strategic goals of Motor Vehicle Manufacturers (cessation of activities, the failure of development plans, bankruptcy) |

| 4 | Critical | The monetary assessment of the impact of 100 to 500 mln. Rub., Or the consequences of a significant effect on the performance of the unit, or in the automotive industry as a whole, and the elimination of the consequences associated with major costs |

| 3 | Greater | The monetary impact assessment from 30 to 100 mln. Rub., Or the consequences of a significant effect on the performance of the process in which the identified risks, but not the elimination of the consequences associated with major costs |

| 2 | Moderate | The monetary impact assessment from 3 to 30 mln. Rub., Or the consequences are insignificant or easy to handle |

| 1 | Slight | The monetary impact assessment <3 mln. Rub., or the consequences of absent or negligible |

The risk is estimated in the course of interviews with experts in the field and / or related areas (other employees in the automotive industry) (involved in the process of structural unit employees). Experts with knowledge on the issue of the corresponding process, evaluate the process risks (probability and significant impact), based on his professional experience, statistics and other sources, which they consider should be used.

To determine the risk factors and the choice of response methods can be used various technologies to collect and analyze information, such as FMEA-analysis, SWOT-analysis, Ishikawa diagram, etc.

In addition to risk assessment processes (operational risk), evaluation is carried out other risks not directly related to individual processes (a corporate-level risk) on the automotive industry. Assessment of other risks organizes the service of internal control and audit by interviewing experts in structural divisions of the automotive industry.

The results of the risk assessment used by heads of departments to make timely and informed decisions, the organization of measures to address the risks and improving internal controls. The results of the risk assessment provided by the structural units are used by the internal control and audit for updating risk maps and the matrix of risk assessment of automotive industry companies, to prepare recommendations for responding to the risks for the planning of audits and inspections and also taken into account in the preparation of external reporting in the automotive industry.

It is quite urgent issue of integration of risk assessment systems in the automotive business activities of the enterprise, for the majority of line staff automotive industry companies are not faced with the risk assessment process, and does not possess the necessary expertise.

The first option is the integration associated with the creation of the structure of each of the units of the automobile company of a special unit or receiving specialist, depending on the scale of operations, responsible for the risk assessment of a particular unit and subordinated to the service of internal control and audit. This option is the most convenient from the point of view of risk assessment implementation rate across the enterprise, however, may lead to a rather large one-off and operating costs in the implementation of risk assessment system. The disadvantage is also the fact that the management units is detached from the risk assessment process, and can not influence the results of the evaluation.

The second option involves the integration of the delegation of authority for the assessment of the risks to employees divisions of the company operating in the structural units in addition to the main job. The advantage of this method lies in the relatively low cost of system integration, as well as direct participation of artists in the process of risk assessment. The disadvantage – weak interest unit employees in the risk assessment of the effectiveness of existing enterprise. Also it should be noted rather weak qualification of personnel departments linear majority of the Russian automotive industry.

Most appropriate is a third option – the appointment of experts from enterprising specialists as part of their training of staff units and the subordination of the Internal Control and Audit in terms of issues relating to risk assessment (see Figure 2.). A necessary step is appropriate motivation of personnel in order to increase interest in the effectiveness of enterprise risk assessment process. Such an enterprise risk assessment system on the one hand will allow for communication with the management departments, on the other hand does not cause a sharp increase in costs, and ensure participation in the process of risk assessment of the most proactive and efficient staff.

In order to cross-breeding Risk of Motor Vehicle Manufacturers possible minimization, including through their insurance with the use of derivative financial instruments.

A particular application of certain derivative financial instruments depends on the size of the enterprise, conditions of insurance (hedging), as well as on the specific goals and objectives set by the company in the process of risk insurance.

It should be noted that the insurance of risks must take into account the fact that the wrong risk insurance can lead to significant losses and the bankruptcy of the company.

References

- Курилова А.А., Курилов К.Ю. Хеджирование валютных и товарных рисков с использованием опционов предприятиями автомобильной промышленности // Аудит и финансовый анализ. 2011. № 2. С. 132-137.

- Курилова А.А. Риск-ориентированный финансовый механизм управления затратами и теория активных систем // Вектор науки Тольяттинского государственного университета. Серия: Экономика и управление. 2013. № 1. С. 85-88.

- Бланк И.А. Управление финансовыми рисками. – Киев: Ника – Центр, 2005. -600с.

- Хохлов Н. В. Управление риском. – М: Юнити-Дана, 1999. – 240c.

- Шуклов Л.В. Взаимосвязь управления финансами c рисками на разных стадиях жизненного цикла организации // Финансовая аналитика: Проблемы и решения. 2011. № 33. С. 21-30.

View this article in Russian

View this article in Russian